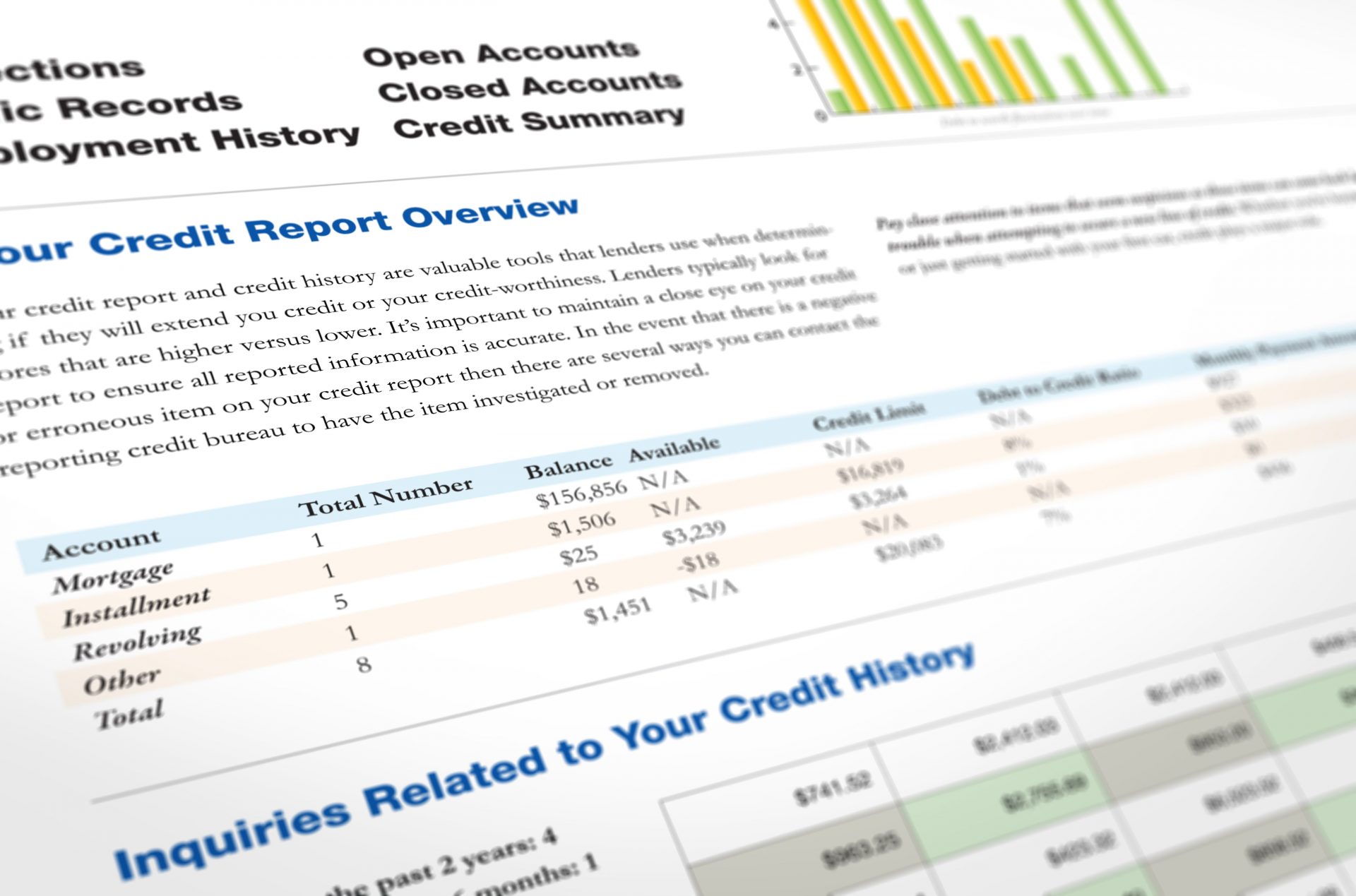

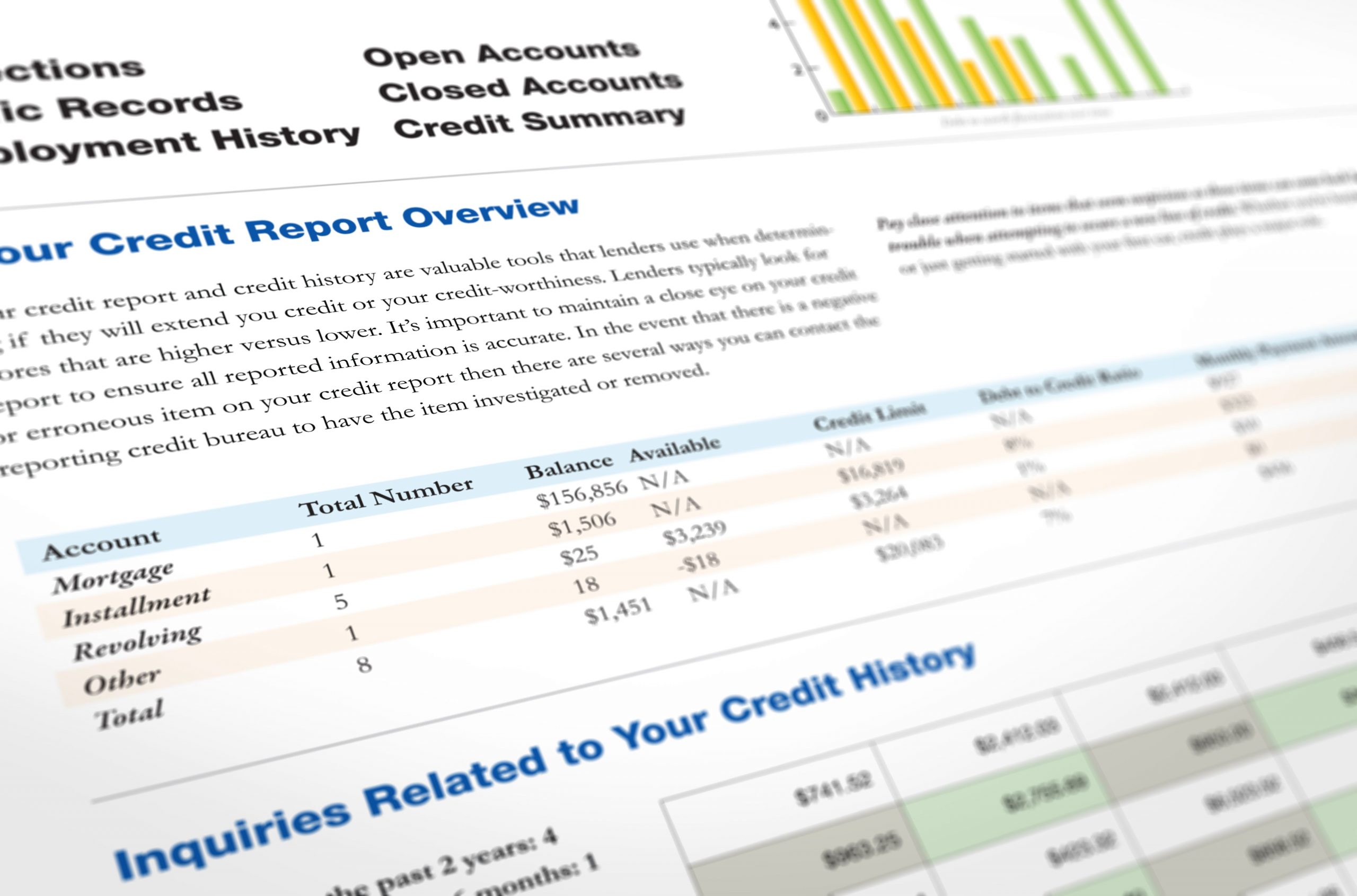

Loans can be a great financial aid to people who lack funds to meet their individual, personal, or business needs. Anyone could need a loan, and to get a loan successfully, one must have a good credit record. Many people apply for loans and have their applications rejected because they have a poor credit history, leading to their loan application rejection. This is one of the most common reasons to get the loan application rejected. This is why it is essential to maintain a good credit record with the back to get Online Loans for bad credit without any difficulties.

Many times, having a good credit record is not in the hands of the loan applicant. The reason could be genuine, but banks and financial institutions generally consider valid reasons for loan processing as they see the customer as risky. This is why the loan application gets rejected. When a person has a low credit score and a poor credit history, they will be considered unreliable when it comes to loan repayment. If a person doesn’t have a regular source of income, they might again face a problem getting the loan as there will be no guarantee that they will repay the loan amount to the bank or the creditors. However, just because you have a poor credit record and low credit score doesn’t necessarily mean that your loan application will get rejected. There are ways through which a person with a low credit score can also have their loan application processed.

Get a loan with a low credit score.

People with low credit scores might have difficulties in getting a personal loan, but it is possible. Multiple new platforms have come up with new loan policies and deals that offer individuals with low credit scores to get a loan at a higher internet rate. This is a relief as such policies allow these individuals to meet their immediate financial needs.

To get a personal loan with bad credit, one must check their bank statements and clear all the outstanding debts and balances to improve their credit scores. It is best to take a couple of months to repair the credit scores before applying for the loan. Loan applicants should quit spending on credit cards until all the outstanding bills are cleared. After that, they must spend the amount will they can afford to pay back each month.

Online Loans for bad credit

In urgent cases, it is best to find a co-applicant with a good credit score who can apply for the loan on behalf of the loan seeker. This will ensure that the loan applicant is trustworthy and will repay the loan amount in due time. You can also look for creditors willing to offer loans to people with bad credit scores at high interest. Make sure that you always learn about the lender and check their credibility.

One must always try to steer clear of a lender who seems fishy. Avoid any loan scams that will only take personal data and never give the loan. Also, learn about the interest rates so that you are not overpaying. If your loan application keeps on getting rejected each time you apply, take a break and repair your credit situation first. Applying for loans over again and getting rejected will make the credit scores poorer. It is important to have scores above 700 for the loan application approval.